ETH Price Prediction: Path to $5,000 Strengthened by Technical Breakout and Institutional Demand

#ETH

- ETH trading above 20-day MA at $4,268.75 indicates bullish technical positioning

- $287 million institutional inflows into Ethereum ETFs demonstrate growing market confidence

- Bollinger Band resistance at $4,853.15 represents key level before $5,000 target

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

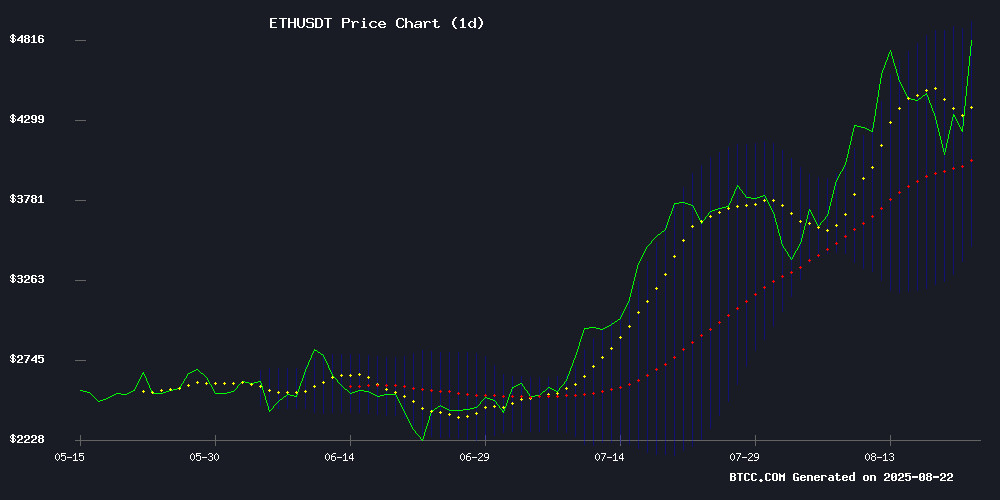

ETH is currently trading at $4,268.75, positioned above its 20-day moving average of $4,180.33, indicating underlying strength. The MACD reading of -13.94, while negative, shows improving momentum as the histogram narrows. Bollinger Bands suggest potential resistance NEAR $4,853.15, with support around $3,507.50. According to BTCC financial analyst Emma, 'The price holding above the 20-day MA combined with narrowing MACD divergence suggests consolidation before potential upward movement.'

Institutional Inflows and Market Sentiment Turn Positive

Ethereum ETFs have broken their outflow streak with a significant $287 million influx led by BlackRock, signaling renewed institutional confidence. The emerging bull flag pattern faces a critical test against Federal Reserve policies, while Ethereum's growing market dominance sparks altcoin rallies. BTCC financial analyst Emma notes, 'The combination of institutional adoption through ETFs and technical breakout patterns creates a fundamentally supportive environment for ETH's medium-term prospects.'

Factors Influencing ETH's Price

Ethereum ETFs Snap Outflow Streak with $287 Million Influx Led by BlackRock

Ethereum exchange-traded funds reversed a four-day outflow streak with $287 million in fresh inflows on August 21, spearheaded by institutional heavyweights. BlackRock's iShares Ethereum Trust dominated the resurgence, capturing $233.5 million of the total, while Fidelity's offering attracted $28.5 million.

The inflows mark a sharp turnaround from the preceding four trading days, which saw $925 million exit Ethereum investment products. Aggregate net inflows now exceed $12 billion across nine ETH ETFs, with total assets under management reaching $27 billion.

ETF holdings hit a record 6.069 million ETH on August 19 - a 46% surge from July 8 levels. The accumulation represents a structural shift in Ethereum's ownership base, with growing portions of supply now locked in long-term investment vehicles.

Ethereum Bull Flag Breakout Faces Fed Test as Dominance Surges

Ethereum's bull flag breakout signals potential altcoin season momentum, with ETH dominance nearly doubling since April to 13.75%. The second-largest cryptocurrency now faces a critical test from Federal Reserve policy signals.

Market structure appears favorable as ETH price action confirms the pattern on 4-hour charts. Historical precedent suggests ETH rallies typically catalyze broader crypto market movements. Resistance at 14% dominance looms as the next battleground, with 16-20% levels awaiting beyond.

Jackson Hole remarks from Chair Powell present a binary catalyst. Any hesitation on rate cuts could trigger correlated drawdowns across crypto assets. The breakout's sustainability hinges on macroeconomic winds aligning with technical momentum.

Institutional Investors Flock to Ethereum, Sparking Altcoin Rally as XYZVerse Presale Tops $15M

Ethereum emerges as the preferred asset for institutional capital, fueling a broader altcoin market surge. The shift comes alongside XYZVerse's $15 million presale milestone, signaling robust demand for new digital asset offerings even before official launch.

Ethereum's price action reflects a market in equilibrium. Trading between $4,165 and $4,791 after a 9.41% weekly decline, ETH finds itself balanced at the convergence of its 10-day ($4,326) and 100-day ($4,319) moving averages. Despite recent volatility, the asset maintains impressive 14.16% monthly and 61.41% biannual gains.

Technical indicators paint a neutral picture. The RSI at 53 and stochastic at 52 show balanced momentum, while a positive MACD (24.64) suggests latent bullish potential. Critical support lies at $3,853, with resistance awaiting at $5,105 - a breakout that could propel ETH toward $5,730.

Market participants watch these technical levels closely as institutional interest reshapes the crypto landscape. The concurrent success of XYZVerse's presale demonstrates how capital inflows are diversifying across both established protocols and innovative newcomers.

Will ETH Price Hit 5000?

Based on current technical indicators and market fundamentals, ETH has a strong probability of testing the $5,000 level in the coming months. The price currently trading above the 20-day MA at $4,268.75 demonstrates underlying strength, while institutional inflows of $287 million into Ethereum ETFs indicate growing confidence. The Bollinger Band upper resistance at $4,853.15 represents the immediate target, with a breakthrough potentially opening the path to $5,000.

| Indicator | Current Value | Signal |

|---|---|---|

| Price | $4,268.75 | Bullish (Above 20-day MA) |

| 20-day MA | $4,180.33 | Support Level |

| Bollinger Upper | $4,853.15 | Near-term Resistance |

| MACD Histogram | -13.94 | Momentum Improving |

| ETF Inflows | $287M | Institutional Support |

BTCC financial analyst Emma suggests that 'while the $5,000 target is ambitious, the combination of technical positioning and fundamental inflows creates a favorable risk-reward scenario for upward movement.'